What are Stablecoins?

The question, what are stablecoins is very important today. A stablecoin is a digital currency that is pegged to a “stable” reserve asset. It generally doesn’t have the features of our regular “fiat currency”. Stablecoins are types of cryptocurrencies whose value is usually pegged or tied to an external asset like the U.S. dollar, Nigerian Naira or even gold.

Bitcoin and altcoins like Ethereum and Cardano offer a huge number of benefits which includes paying for goods/services as well as making cross border payments but one key drawback is that prices of cryptocurrencies like these always fluctuate and are highly unpredictable.

This volatility makes it difficult for everyday people to use and that’s where Stablecoins come in. Stablecoins dramatically reduces volatility when compared to unpegged cryptocurrencies like Bitcoin and results in a form of digital money that is better suited for normal people to use for day-to-day business transactions. Keep reading to know what are stablecoins.

5 Best Stablecoins to invest in 2022

• Tether (USDT)

• Dai (DAI)

• Binance USD (BUSD)

• USD Coin (USDC)

• TrueUSD (TUSD)

Noteworthy; NGNT is a stablecoin pegged 1:1 to the Nigerian Naira issued on Waves Protocol. NGNT is not a legal tender.

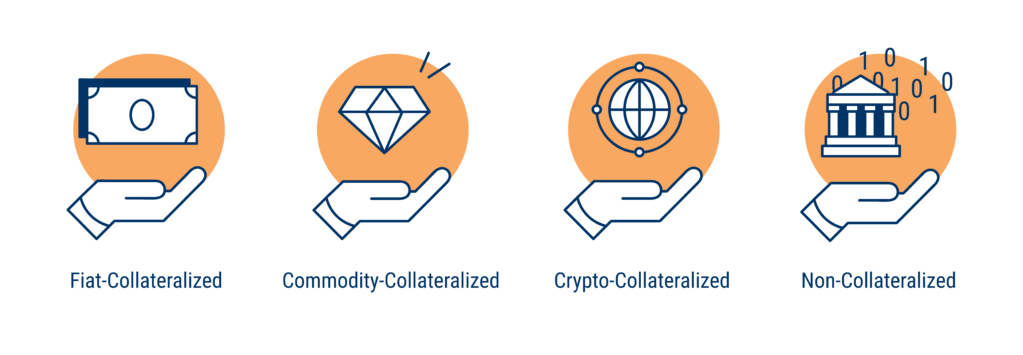

What are stablecoins and their types of collateral

Part of understanding the basics and fundamentals of what are stablecoins is that they could be grouped into 4 categories, according to their collateral (what they are pegged to or backed by).

You May Also Like: How to Redeem Gift Card in Nigeria to Naira

A) Stablecoins backed by Fiat: Fiat currency is the most common collateral for stablecoins. As the name implies, such types of stablecoin have the backing of fiat currencies like the US Dollar, Euro, Chinese Yuan or Nigerian Naira which are kept as collateral.

B) Stablecoins backed by Commodity: Some stablecoins are tied to the value of real estate or precious metals such as gold or silver.

C) Stablecoins backed by Cryptocurrencies: It’ll interest you to know that some stablecoins even use other cryptocurrencies, such as ether, the native token of the Ethereum network, as collateral.

D) Stablecoins backed by Seigniorage: Seigniorage means profit made by a government by issuing currency. In this case, we’re talking about governance of a process where smart contracts on decentralized platforms can serve as independent backers for such stablecoins.

How you can save with Stablecoins in Nigeria to hedge inflation

According to NairaMetrics, “Nigeria’s inflation rose to 16.82% in April 2022, following a similar uptick recorded in the previous month as a result of the increase in energy and food prices.”

Standard of living or do we say cost of living is increasing exponentially almost every month in the country but it doesn’t reflect substantially in the earnings of those in the formal sector.

This has awakened in Nigerians the need to find a viable alternative to the continually deflating Naira, and this is why you are probably searching for – what are stablecoins as this is where stablecoins come into play. Nigerians could use stablecoins like USDT for international transactions, purchasing crypto assets or even converting other crypto assets in their portfolio to stables during a bearish market.

There are crypto exchanges that give up to 5% APY when you save your stablecoins with them. How do you start? By having USDT.

With Prestige Services, you can easily buy USDT at no extra cost and hold securely for as long as you wish. To buy USDT with Prestige kindly click on the link to BUY USDT WITH PRESTIGE

We hope this article helped you learnt what are stablecoins and how you could use them hedge against inflation in Nigeria. If you liked this article, then please share with your network.